The Sad State of America's EV Charging Infrastructure and Lessons from China's Impressive Rollout

The Stark Contrast Between U.S. and Chinese EV Charging Infrastructure

China’s rEVolution

The EV revolution is happening in China. I live in Shenzhen, where most new cars sold are electric. All new parking spaces in Shenzhen built after October 8th, 2023 are required to be wired for at least 7 kW EV chargers. The taxis and buses are already fully electric. All of them. And it has been this way since 2017. Even the most rural parts of China are transitioning to EVs. Every price point has multiple EV options.

The tidal wave of EVs in China didn’t come out of nowhere; through deliberate central planning and technological breakthroughs, an EV ecosystem now exists in China and is so robust that nearly 40% of new car buyers are choosing EVs. China has already reached its 2025 EV-related targets Beijing set as recently as 2022, as it has catalyzed a laissez-faire adoption of EVs across the nation.

EV adoption is now growing organically, which wouldn’t be possible if people were concerned about where to charge their cars. The EV charging infrastructure in China continues to accommodate the mammoth EV fleet.

America’s EVolution

While some 5-car garages in wealthy American homes may resemble a shift to EVs, the U.S. is in an EV crawl in contrast to China’s sprint. With EV adoption hinging critically on the availability and accessibility of charging points, the U.S. is seemingly at a crossroads – affordability of new models and a robust charging network.

Though EV sales in the U.S. have seen a commendable rise, public EV charging infrastructure in the U.S. is growing at half the rate as EV sales this year. The data indicates a concerning trend: the U.S. is projected to install fewer public EV chargers this year than in the prior, marking the second year of decline. This is the opposite of the right direction.

Charging Inequality

Our analysis juxtaposing the 2021 U.S. Census median household income against the zip code distribution of public EV chargers uncovers a glaring disparity; a staggering 75.6% of zip codes (30.7% of U.S. households) lack any public EV charging options. Moreover, the average median household income of zip codes with charging stations significantly eclipses the national average in every state/territory, pointing to an inequitable concentration of infrastructure in wealthier locales.

The average median household income of zip codes without a public EV charger is $77,690, whereas those with at least one public EV charger is $99,968. EV chargers are much more common in wealthier areas; 78% of U.S. zip codes with a median household income above the national average have public EV chargers.

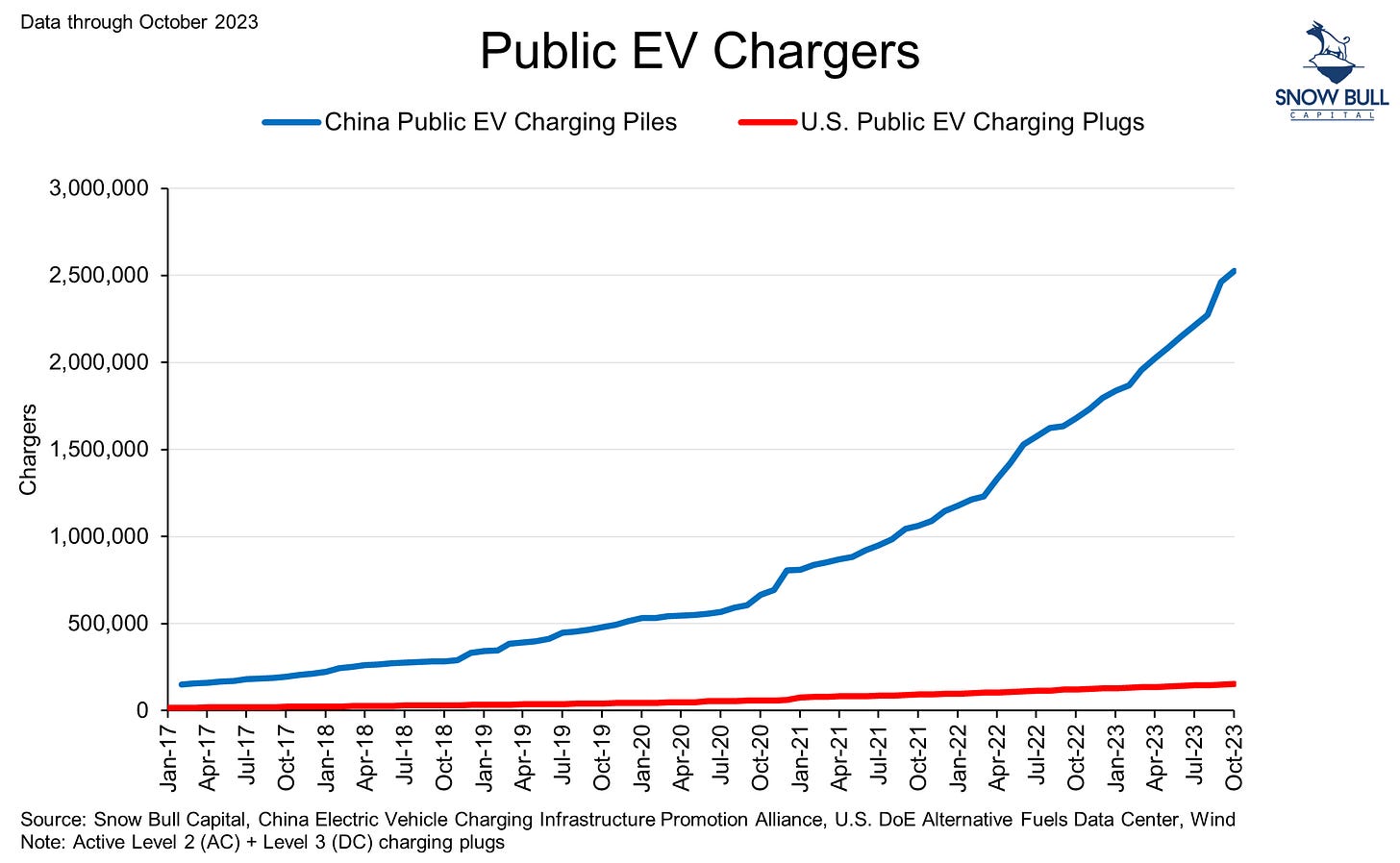

The Hare

For every 1 public EV charger in the U.S., China has 16. That is especially staggering given China’s EV fleet is only 5-6x larger than the United States’. China now has over 8 million EV chargers. The U.S. only keeps track of public chargers, but in China—where both are tracked—there are 1.9x more private EV chargers vs. public chargers. As of the end of October, in China, there is 1 EV charger for every 2.7 EVs on the road. The ratio of public chargers to EVs in China is 1:8, compared to a paltry 1:27 in the U.S., indicating a far more saturated and accessible network. This is why the U.S. is already being plagued with long ques for chargers, and will become twice as worse if the trend continues.

The Tortoise

The U.S. is facing a serious issue with EV charging infrastructure while China is shattering all excuses the U.S. has been making. It is most convenient for EV owners to charge their cars at home, but many American EV owners lack access to home charging (due to older infrastructure, unwilling landlords, cost, etc.), so they are forced to use public EV chargers. This discourages many Americans from considering an EV in the first place. The U.S. is also a sprawling country; therefore, convenient and reliable Level 3 DC fast chargers installed along highways are necessary for many Americans. Last year, China had 28x more Level 3 EV chargers than the U.S., and this year, China has installed 41x more than the U.S. Level 3 chargers are largely concentrated in wealthy pockets of America, even more so than Level 2 chargers.

China's aggressive EV infrastructure expansion is epitomized by the efforts of just one of its provinces: Guangdong.

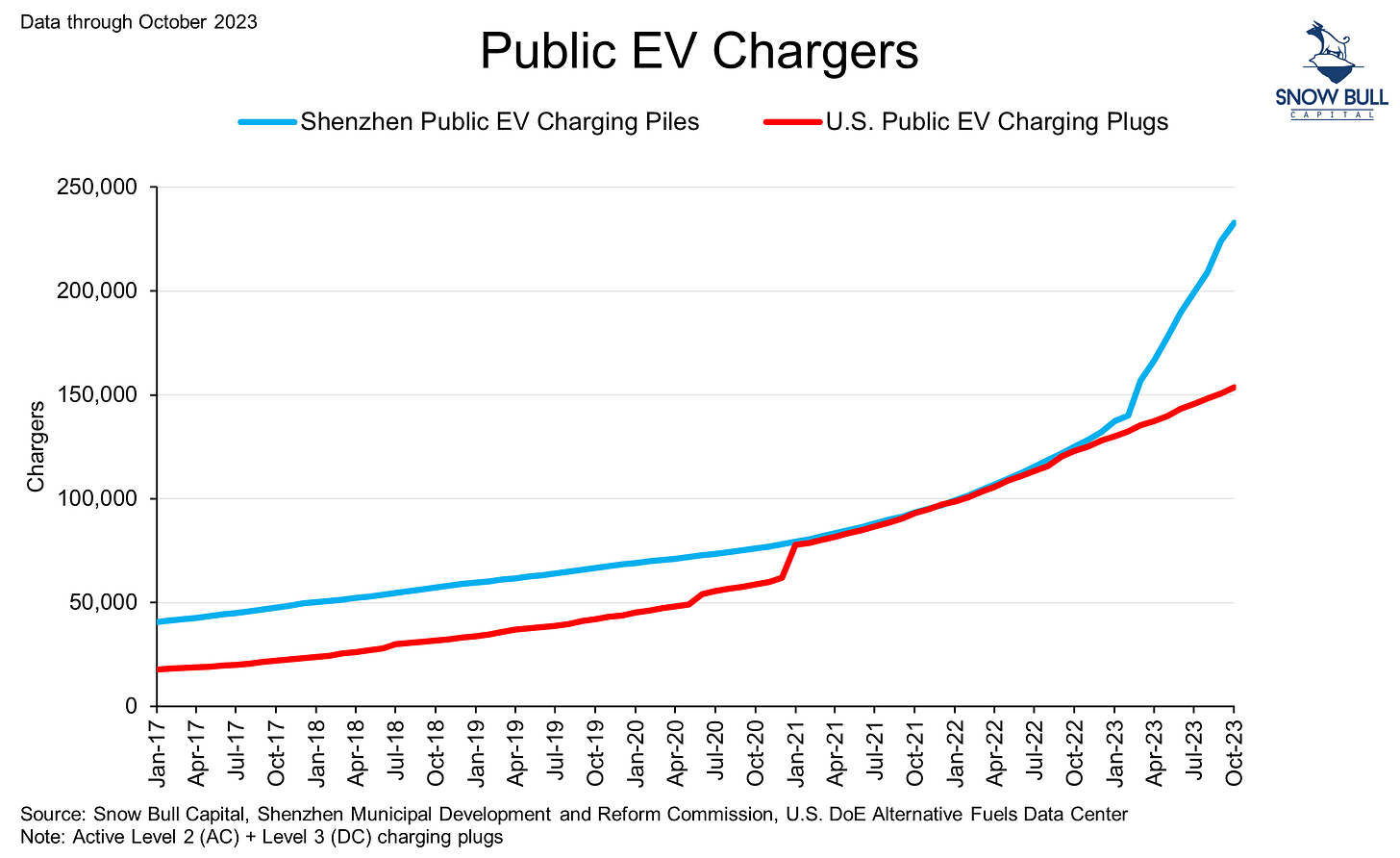

Is it ridiculous to compare the installed charging infrastructure of a single province to an entire country? Absolutely. How about comparing a single city to the entire United States? See below…

In 2023, China has installed 28x more public EV chargers than the U.S. Shenzhen has this year alone installed 4x more public EV chargers than the entire U.S. In just October, there were a quarter million private EV chargers installed in China—that’s 100,000 more than public EV chargers have ever been installed in the U.S.

The United States’ target is to have 500,000 public EV chargers installed by 2030. At China’s current installation rate, that would take less than five months. Despite the infrastructure bills, “commitments”, consolidation, new standards, etc., the U.S. doesn’t appear to be trying.

Tesla’s Supercharger network, which is opening up to non-Tesla EVs, accounts for 63% of America’s Level 3 chargers, and 14% of total public EV plugs. Tesla is installing an average of 15 Superchargers per day in the U.S. In the time you have been reading this, four of China’s largest public EV charging companies have installed more chargers, each.

As an American who wants the best for America, this is a really sad reality. The United States isn’t going to magically transition to a green economy by installing 3,019 public EV chargers a month. One company (深圳车电网运营 Shenzhen CLOU Electronics Co., Ltd., SZ:002121) whose office I can see out my window, installed over 17,000 public EV chargers in this city alone last month, 5x more than the entire United States. You get the point. I hope America will soon. This is another example of why we moved our company to China. The U.S. needs to wake up, remove the red tape, and work with and learn from the Chinese to transition to a green economy.

Next up: why the United States needs Chinese EVs

Hi Taylor

love your twitter. Also really enjoyed your interview with Stephen Hsu.

I am curious to know what electricity prices and gasoline/diesel prices (don't even know if diesel is a thing in China) are in China relative to the states. Could this be a factor.

Also, do hybrids have a large market share in China as part of the 40%.

Thanks.

thanks

Great insight and a valuable (rare) look into the Chinese EV charging market. I'll link back to this in today's evuniverse.io newsletter. Thank you, Taylor!